How can property investors reach zero debt AND still hit a four-figure passive income each week?

And what do we mean when we say “retire” the debt, anyway? What does this look like and, importantly, WHEN should you start this process?

Folks, in today’s special Q&A episode we’re circling back to a few basic principles and fleshing out some confusion when it comes to property investing. This includes clearing air (and tidying up our language!) when it comes to being informed of the step-by-step investing process.

For one – you’ve no doubt heard us talk about achieving $2,000 in passive income… well, WHERE exactly does this money come from? Is it just your rental income?

As part of this we’ll also be covering “Failure to Launch” principles and “Investment Remorse” – the latter, which may actually be a more common feeling than you think! So what should you consider if you find yourself second guessing your asset selection?

PLUS, because we’re officially in Spring – this episode comes with a WARNING about this year’s “Spring Selling Season”… ‘cos there’s a critical shift taking place ALL home buyers need to be aware of.

Suss the exact questions we answer below – or, better yet, simply hit play and get the gold now 😊

Free Stuff Mentioned

- RBA September 2021: Australia’s Planned Recovery NOT So Predictable?

- FREE Book – The Armchair Guide To Property Investing – How to retire on $2,000 per week

- Article on API Magazine – Ben’s $500,000 Mistake

- REA Insights – REA Insights Housing Market Indicators Report September 2021

- Episode 344 | Have You Made The Wrong Investment Decision?

- Episode 354 | The Rise of Family Office Wealth & Investing Without Emotion

- Episode 350 | How BEN Did It: A Passive Income of $190,000 Per Year… At 50!

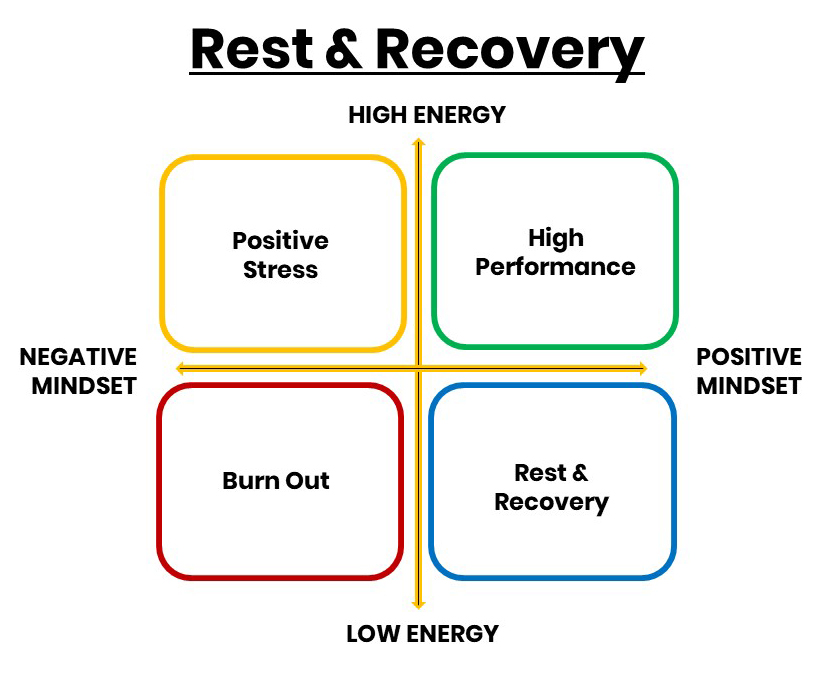

- Rest & Recover Graphic – Scroll to the bottom of this page

The Questions We Answer

Question from Stevo on “Post Purchase Restlessness”

Hi guys 12 months after purchasing an investment property, I’m starting to get this feeling that it might not of been a great purchase and also restlessness about wanting to “go again” and am worried the growth might not be quick enough compared to capital cities. I say that based on an old episode where you mentioned something about the limitations or a price ceiling in certain areas based on the demographics.

Obviously being a regional property, which doesn’t have the same wage potential as capital cities, am I exposed to the idea that the growth has happened and it won’t come again?

The property is available via this link. It’s shown growth over the past 20 years in capital and rental return.

For reference the idea of “inner city” living (albeit in Mildura) has exploded recently and is the driver of the growth over the past five years. The council and state govt have invested to upgrade the riverfront (very close to the CBD) and has completed stage one. Stage two has started to attract funding and small upgrades/extensions have started. Data suggest Mildura will continue to grow in population albeit slower than Geelong and Bendigo for example, however, it is still positive growth compared to other regional towns this distance from capital cities (which are often stagnate or negative). Major industries – agriculture and tourism, health, Govt. Sorry for the long-winded question and info.

Also, is this a normal feeling people get (delayed remorse)?

Question from Ebony on “When is the best time to sell your investments?

Hello, I have a question around when is the best time to sell your investments? My husband and I are mid 30s and have two investment properties. Right now, in our town the property market is a sellers’ market and prices are crazy. Our accountant has recommended that we should seek advice from a financial advisor and possibly sell both investments because they are positively geared and that we would be better off building a new home as an investment or investing elsewhere. I am really unsure about this because I think that we already have 2 great investments, and we would be potentially paying more down the track for land should the market stay the same. However, we have had one property for 2 years and the other for 1 year and could look at earning $100K off the sale of each investment. I guess it’s hard to know if the market will stay at these prices or crash when interest rates rise. Really after some advice from someone who is knowledgeable about property investments. Thank you.

Question from Paul on Retiring Debt

Can you elaborate on what you mean when you talk about retiring your debt? I’m confused by what you mean by this.

Question from Chris on “$2,000 per week in passive income”

Hi Ben and Bryce, Love your work. 👍 I’m not sure if you’ve mentioned it before, and you probably have, but I would like to know where the $2,000 a week comes from? Is it pure rental income (taxed) above expenses for the portfolio or is it accessing equity against capital growth (is this now defunct with new lending criteria?) or is it a combination of both? Thanks in advance. This is a major thought blocking me from moving forward. 👍

Rest, Recovery & High-Performance Graphic

Here is the graphic Bryce was referring to in today’s Life Hack:

Subscribe On Itunes

Subscribe On Itunes Subscribe On Android

Subscribe On Android